Table of contents

No headings in the article.

Photo by Shubham Dhage on Unsplash

In this series of 5 articles, you will gain a complete understanding of what DeFi means. We begin this series with a basic introduction of what the term DeFi means and the promise it holds.

DeFi is Decentralization DeFi is short for Decentralized Finance. It refers to an ecosystem of financial products and services built on blockchains.

Traditional banks are centralized. When you shop online, you need to send an instruction to your bank, and if your bank agrees, only then is the payment released to the online shop you are buying from. This is called centralization. The bank is the intermediary here, who decides whether or not to make the payment go through. Similarly, when you give a cheque or demand draft to someone, you pay the bank, and then the bank pays the person you want to deal with. Decentralization aims to remove the need for a 3rd party. The entire idea behind the invention of the blockchain was to make it a permissionless, peer-to-peer financial instrument. When everything is written on an open-source, transparent public ledger, you do not need a bank to check its records and ledgers and then decide for you. You can run smart contracts that follow straightforward programming without the need for any trust in or mistrust towards anyone! Hardcoded logic says if this happens, then that happens. It removes the need for having the expense of a 3rd party like a bank with tons of employees and expensive corporate office towers. Blockchain technology distributes the servers of a bank to every user’s computer, building a connected web that out-computes and out-competes the capabilities of the best financial processors like the biggest banks or VISA, MasterCard. PayPal, etc.

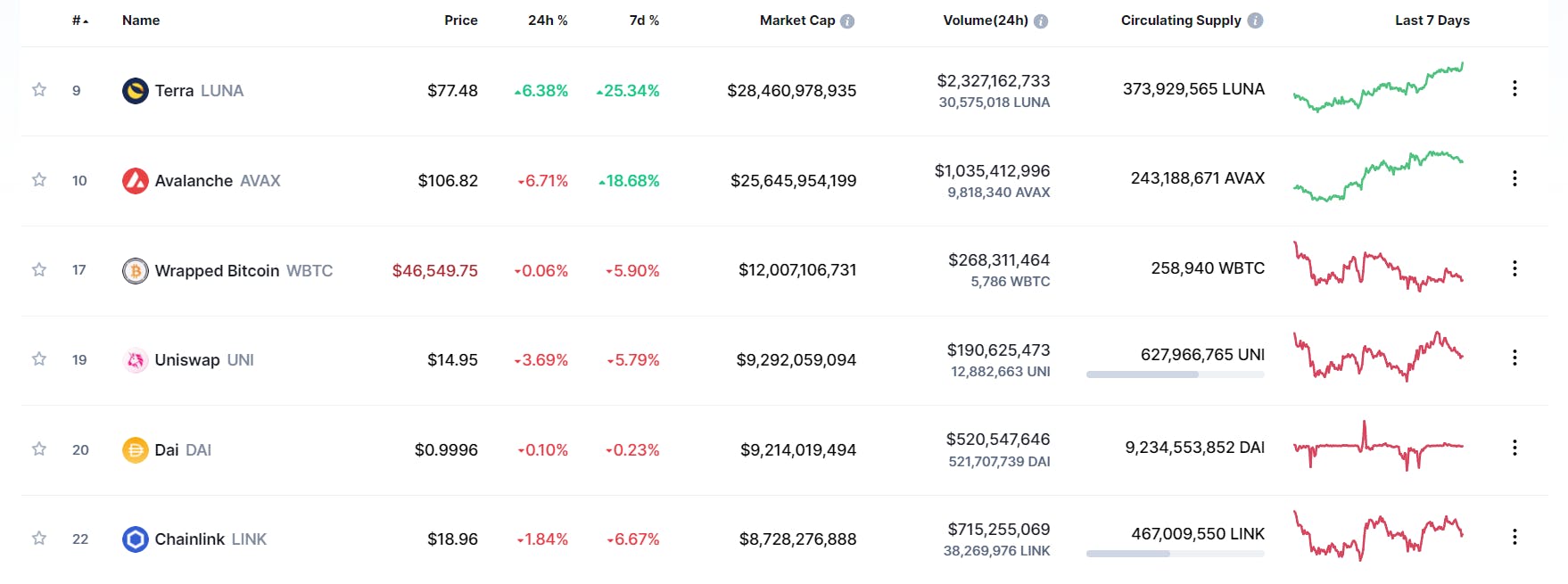

A sample of DeFi projects. Image courtesy CoinMarketCap.

A sample of DeFi projects. Image courtesy CoinMarketCap.

What Are DApps? DApps (Decentralized Applications) are applications that are built on top of the base blockchains like Ethereum and Binance Smart Chain. Contrary to popular perception, Bitcoin - the original blockchain, too can support DApps and smart contracts, and is not ‘just a store of value’. The new developments of the Lightning Network and Taproot update among other developments will slowly & inevitably bring the world of popular DeFi applications to Bitcoin. For the moment though, the majority of the DApps are running on the 2nd and 3rd biggest blockchains.

This is how DApps appear. Image courtesy Trust Wallet.

This is how DApps appear. Image courtesy Trust Wallet.

When you run a wallet like Trust Wallet, you can open the DApps browser option and explore a variety of DApps that are listed. This is akin to the Google Play Store or Apple iOS Store apps, where you can open other apps that perform various functions like messaging, games, or social media. MetaMask is the most popular wallet for using DApps, but it works slightly differently. It doesn’t show you a list of DApps the way Trust Wallet or Google Play shows you apps. Instead, you can go to a DeFi website or a DApp link/website in the browser on a PC or mobile and use the “Connect Wallet” option displayed on the page to connect to your MetaMask wallet. This functionality opens a whole world of possibilities from identity verification to log in and so much more.

The Three Broad Functions Of DeFi Currently

- Banking Services (akin to real-world Banks and NBFCs, i.e. Non-Banking Financial Services).

- Peer-to-peer pooled lending and borrowing (akin to Crowdfunding, but more systematic and defined like a Bank’s interest rates).

- Allowing advanced financial products - Decentralized Exchanges (DEXes), tokenization platforms, prediction markets, and derivatives.

Within these three broad categories, there is a mushrooming world of innovative services growing bigger every day - everything from software development tools, to subscription payment processing, to KYC and AML tools, identity verification and so much more. The sky's the limit in the possibilities of what can be built when the limitations, rules, and costs of traditional banking services are removed. For example, you can get a loan through DeFi right now even if you have a bad credit score and no traditional bank will give you a loan, as long as you fulfill the requirements written in the automated smart contract. You can get a loan even if you have no bank accounts. This is a boon for billions of unbanked people around the world. All you need is a smartphone and internet connection, which is already more widespread than the reach of traditional banks.

Traditional Banks have to face defaulters, scams from borrowers and insiders, security breaches and hacks, etc. DeFi services too get hacked, but at least the code is open-source in most cases and anyone can verify the set rules before they trust the system. In 2008, during the financial meltdown caused by the over-inflated property market, a lot of banks were bailed out by governments by using public money. This was a major reason for the birth of Bitcoin and blockchain technology, when the pseudonymous founder by the name of Satoshi Nakamoto, launched the Genesis Block of the Bitcoin blockchain with a news clipping referring to “Chancellor on the brink of second bailout to banks”. This will never happen in DeFi. Banks, Central Banks, and Governments can game the system by printing more money and covering their mistakes (at the cost of the real wealth of the citizens), but with DeFi and blockchain technology, the governance of the actions of the system and organizations around them (DAOs or Decentralized Organizations) are given to the participants. DeFi allows you to be your own bank.

DApps are open-source applications that do not require placing your trust in the hands of another organization like a bank, and all the accounting is usually transparent and visible to the entire world for all to see, check and verify, protected by trusted and secure cryptographic techniques without a single point of failure.

Initially, on the internet, a file was kept on a single server, and computers all over the internet could download it from that place. Then came torrent technology, which distributed the entire file or pieces of it on thousands of computers. This allowed people to download parts of the file from various people and complete the whole file on their computers. Recently, there was a trending hashtag #InternetShutdown, when a lot of social media sites and AWS (Amazon Web Services) based sites became inoperational. This is the risk of centralization, when a central server goes down, it takes down all other services that depend upon it. If these sites were instead running on a decentralized storage and retrieval service like the InterPlanetary File System (IPFS), i.e. the Filecoin blockchain, they would be distributed and decentralized among millions of computers and would not have gone down.

A DEX is also similar. It’s like a bank or stock exchange, that has no vaults, no offices, and no employees, but allows the full functionality to deposit funds and trade with other users.

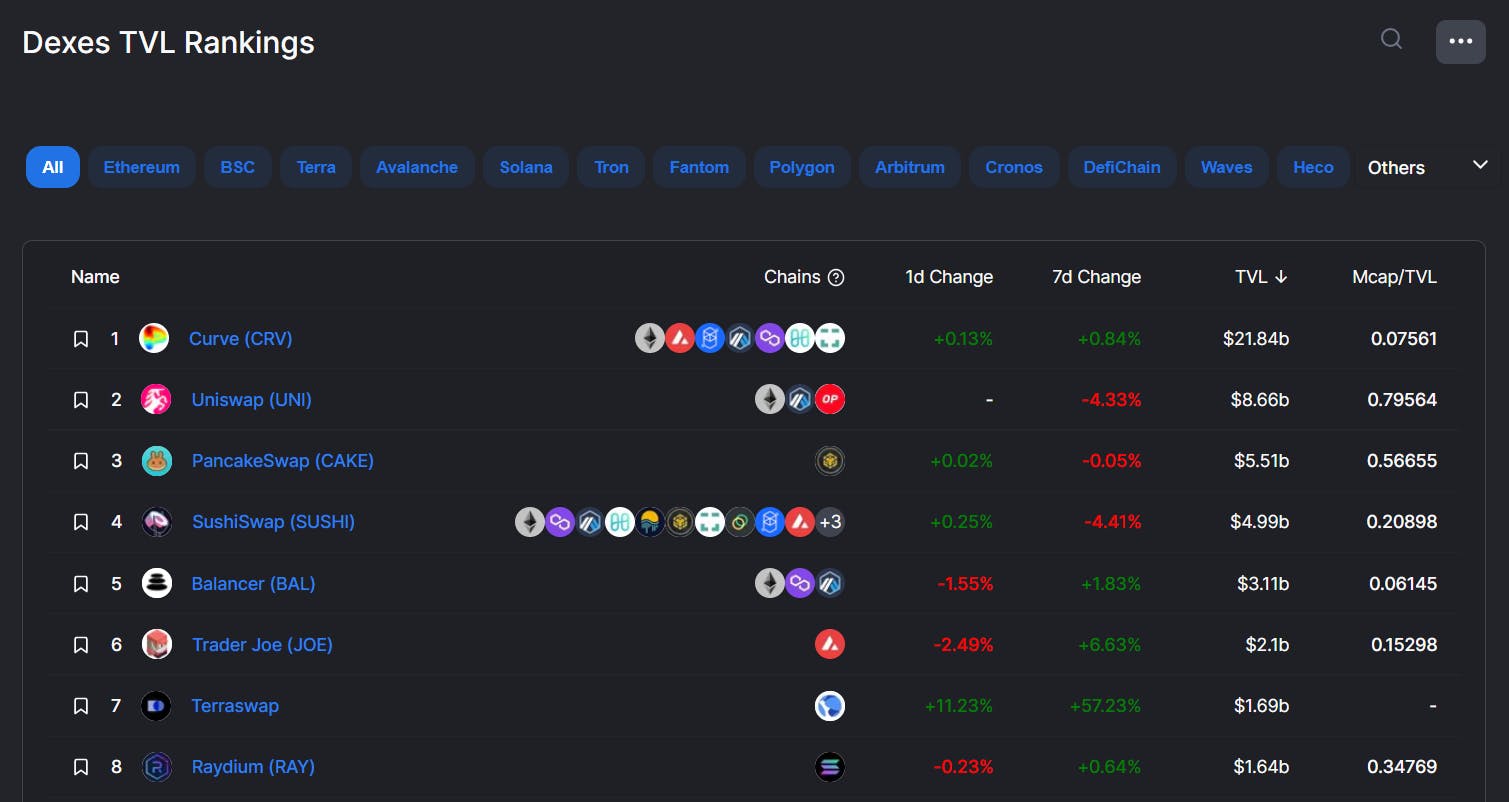

Some of the leading DEXes today. Image courtesy DeFi Llama.

Some of the leading DEXes today. Image courtesy DeFi Llama.

Collectively, all these innovations are referred to as Web 3.0, the next iteration of the internet. DAOs are the next chapter in the way companies and organizations are set up and run. The rules of the organization are set in stone in a transparent smart contract. Instead of the traditional company structure with the CEO, CFO, managers, and employees, a DAO is run wholly by a community of users. There is currently fervent talk among the Reddit.com/r/CryptoCurrency, r/WallStreetBets, and r/WallStreetBetsCrypto communities to buy out Reddit.com by acquiring a 51% stake in the company when it goes public soon. They are planning a DAO to design a system through which the community of users that create content and provide the popular social media site with usage and traffic, will ultimately get to own the site. There is no hierarchy or top-down system of control in a DAO. Decisions are taken based on the distributed governance votes to all the users, who are in effect all partial owners.

The icon of a DAO. Image courtesy Wikipedia Creative Commons.

The icon of a DAO. Image courtesy Wikipedia Creative Commons.

Wikipedia also refers to DAOs as Algocracy.

To sum up, DeFi is a revolutionary movement of decentralizing finance and giving financial power back to the people, instead of the banks, and it is something that must be taught in not just B-schools, but all schools to prepare the next generation for the new world of possibilities and digital growth.